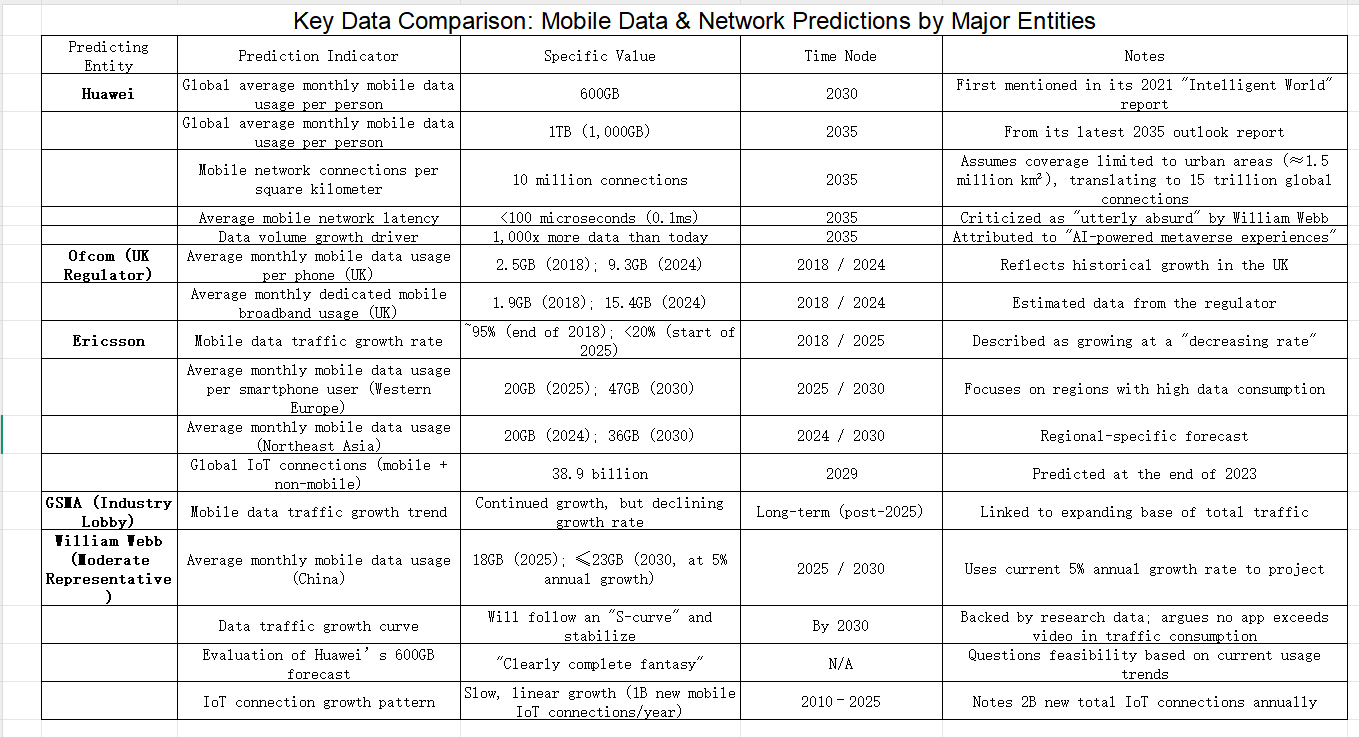

According to a report by Lightreading, Huawei’s "Intelligent World" series of reports notes that mobile data usage continues to surge in countries with extremely high smartphone penetration. Data from the UK communications regulator Ofcom shows that the average monthly data usage per mobile phone in the UK has risen from 2.5GB in 2018 to 9.3GB in 2024. For dedicated mobile broadband plans, the regulator estimates monthly usage has jumped from 1.9GB to 15.4GB over the same period. However, this growth pales in comparison to the projected surge between now and 2030. By then, global average monthly mobile data usage per person is expected to reach 600GB, and just five years later—by the mid-2030s—that figure will skyrocket to 1 terabyte (TB).

The "600GB monthly" data point for 2030 was first outlined in Huawei’s 2021 report, while the "1TB monthly" forecast comes from the company’s recently released 2035 outlook. These reports suggest an unprecedented wave of technological transformation will unfold over the next 5 to 10 years. By the early 2030s, ordinary people may be permanently connected to machines—much like Neo in The Matrix—able to download a lifetime’s worth of martial arts skills directly to their cerebral cortex in a single millisecond.

Currently, the growth rate of mobile data traffic is slowing, and the value of 5G has been repeatedly questioned. Lightreading editors accuse Huawei of operating in a parallel reality where "holographic home adoption and ubiquitous robots" are the norm. The report’s authors even seriously claim: "By 2035, it may be common for average households to own private aircraft, ushering in an era of 3D urban mobility."

Lightreading’s article also notes that Ericsson, Nokia, and the GSMA (the mobile industry lobby group) have all acknowledged the slowing growth in traffic—with the exception of Huawei. Ericsson’s latest "Mobile Market Report" points out that mobile data traffic is growing at a "decreasing rate": from approximately 95% at the end of 2018 to less than 20% at the start of this year. Ericsson predicts that by 2030, in Western Europe—where mobile data consumption is highest—the average monthly data usage per smartphone user will rise from around 20GB today to roughly 47GB. Unless other devices replace smartphones as the biggest contributors to mobile traffic, the Swedish company’s forecast is vastly different from Huawei’s.

Overall, the industry is now divided into two camps. One is the "moderates," analysts, author, and former Ofcom executive William Webb, whose views are often seen in written commentary. The other is the "radicals," who believe new applications and device forms will drive sustained traffic growth. Artificial intelligence (AI) may be relevant here, but no radical has been able to explain exactly how. Many others fall into a "middle ground" between the two camps.

Webb, who already criticized Ericsson’s recent forecast, was unsurprisingly dismissive of Huawei’s report. For years, he has maintained—backed by research data—that data traffic growth will eventually follow an "S-curve" and stabilize by 2030. He points out that no current application consumes more traffic than video, and the only impact of AI-generated video will be to replace human-created video. Moreover, there is a limit to how much video a person can watch in 24 hours. Frequent use of other AI services (such as image and text-based services) may even lead to a decline in video consumption. Additionally, data compression technology continues to advance.

In an email to Light Reading, Webb stated: "The 600GB forecast is clearly complete fantasy." He notes that current monthly mobile data usage in China is approximately 18GB, with an annual growth rate of 5%. Even if this growth rate remains unchanged, monthly usage will not exceed 23GB by 2030. Ericsson’s data shows that monthly usage in Northeast Asia was 20GB last year and is expected to reach 36GB by 2030. Similar to Ericsson, the GSMA stated in its "Mobile Connectivity Report" that mobile traffic will continue to grow, but the growth rate will gradually decline as the base expands.

Huawei’s report also claims: "We anticipate that by 2035, mobile networks will support 10 million connections per square kilometer, with an average latency of less than 100 microseconds (µs)." Even if coverage is limited to urban areas—approximately 1.5 million square kilometers globally—this would translate to a total of 15 trillion mobile connections worldwide. Furthermore, 100 microseconds is equivalent to 0.1 milliseconds (ms), a target Webb describes as "utterly absurd."

Webb said: "Achieving this goal is almost impossible, and it is completely unnecessary. There are not even many applications today that require 10ms of latency." He added that over the past 15 years, IoT (Internet of Things) connections have grown slowly and linearly—with approximately 1 billion new mobile network IoT connections each year and 2 billion new IoT connections overall annually. At the end of 2023, Ericsson predicted that by 2029, the total number of global IoT connections (including both mobile and non-mobile technologies) will reach 38.9 billion.

Huawei’s explanation for its high data usage forecasts is, as the company wrote in its latest report: "AI-powered metaverse experiences enabled by new devices will generate 1,000 times more data than today." However, the "1,000x" figure seems arbitrary—it resembles a round number plucked from the "metaverse" and tossed into the real world like a hand grenade.