Lumentum Announces Fiscal Third Quarter 2024 Financial Results

Net revenue of $366.5 million

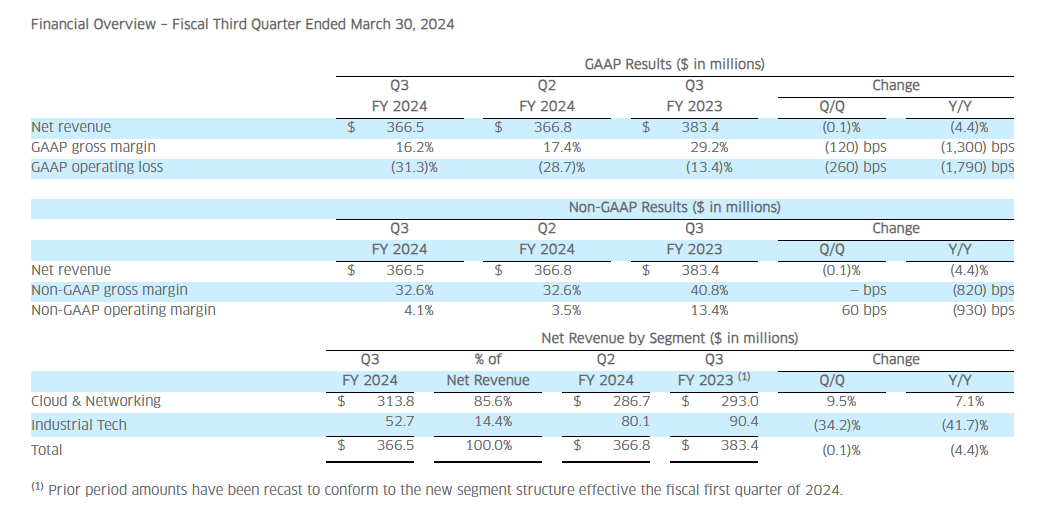

GAAP gross margin of 16.2%; Non-GAAP gross margin of 32.6%

GAAP operating loss of 31.3%; Non-GAAP operating margin of 4.1%

GAAP diluted net loss per share of $1.88; Non-GAAP diluted net income per share of $0.29

SAN JOSE, Calif.--(BUSINESS WIRE)-- Lumentum Holdings Inc. (“Lumentum” or the “Company”) today reported results for its fiscal third quarter ended March 30, 2024.

“Lumentum is well-positioned to capitalize on surging cloud data center demand driven by the exponentially increasing requirements of artificial intelligence,” said Alan Lowe, President and CEO. “We are making significant strides in developing new products and customer programs, and expanding production capacity to capitalize on exciting opportunities that we expect will meaningfully increase calendar 2025 revenue and beyond.”

“Our third-quarter revenue and EPS exceeded guidance midpoints, with data center revenues achieving a record quarter. The next few quarters’ revenue will continue to be burdened by telecom customer inventory challenges as telco spending has slowed but we are highly confident in our market position and the future recovery and growth in our telecom business,” concluded Mr. Lowe.

Fiscal Third Quarter Highlights:

Net revenue for the fiscal third quarter of 2024 was $366.5 million, with GAAP net loss of $127.0 million, or $1.88 per diluted share. Net revenue for the fiscal second quarter of 2024 was $366.8 million, with GAAP net loss of $99.1 million, or $1.47 per diluted share. Net revenue for the fiscal third quarter of 2023 was $383.4 million, with GAAP net loss of $39.3 million, or $0.57 per diluted share.

Non-GAAP net income for the fiscal third quarter of 2024 was $19.6 million, or $0.29 per diluted share. Non-GAAP net income for fiscal second quarter of 2024 was $21.7 million, or $0.32 per diluted share. Non-GAAP net income for the fiscal third quarter of 2023 was $51.8 million, or $0.75 per diluted share.

The Company held $870.9 million in total cash, cash equivalents, and short-term investments at the end of the fiscal third quarter of 2024, down $353.1 million from the end of the fiscal second quarter of 2024. In March 2024, we paid the remaining $323.1 million principal amount of the convertible notes due in 2024 in full upon maturity.

The tables above provide comparisons of quarterly results to prior periods, including sequential quarterly and year-over-year changes. A reconciliation between GAAP and non-GAAP measures is contained in this release under the section titled “Use of Non-GAAP Financial Measures.”

Business Outlook

Lumentum expects the following for the fiscal fourth quarter 2024:

Net revenue in the range of $290 million to $315 million

Non-GAAP operating margin of (3.0%) to 1.0%

Non-GAAP diluted earnings per share of ($0.05) to $0.10

These projections also exclude certain unusual expenses, including factory under-absorption, due to factory consolidations and transitions, restructuring, other synergy attainment and integration activities, and inventory reduction activities, related to prior acquisitions and the COVID-19 pandemic. These expenses are related to one-time events, and we expect these will decline over the coming quarters. These expenses for our third fiscal quarter can be found in our GAAP to non-GAAP reconciliation tables.

We have not provided reconciliations from GAAP to non-GAAP measures or the equivalent GAAP measure for non-GAAP measures in our outlook, as they cannot be provided without unreasonable effort. A large portion of non-GAAP adjustments, such as restructuring charges, stock-based compensation, non-GAAP income tax reconciling adjustments, acquisition related costs, and other costs and contingencies unrelated to current and future operations are by their nature highly volatile and we have low visibility as to the range that may be incurred in the future.